Planning for retirement can feel daunting, but understanding your Ohio 457 plan doesn't have to be. This guide simplifies the process, empowering you to make informed decisions about accessing your retirement savings and securing your financial future. We'll cover everything from choosing investments to navigating withdrawals, offering actionable steps for a comfortable retirement.

Understanding Your Ohio 457 Plan

Your Ohio 457 plan is a tax-advantaged retirement savings vehicle designed for Ohio public employees. Contributions grow tax-deferred (meaning you don't pay taxes on the earnings until withdrawal), offering significant long-term benefits. However, early withdrawals typically incur penalties, emphasizing the importance of careful planning. Did you know that properly utilizing an Ohio 457 plan can significantly boost your retirement income?

Investment Choices: A Personalized Approach

Your 457 plan likely offers various investment options, each with a different risk/return profile. Understanding these is crucial for building a portfolio aligned with your goals and risk tolerance. Common options include:

- Stable Value Funds: Lower-risk investments offering steady, predictable returns. Ideal for those prioritizing capital preservation.

- Mutual Funds: Diversified portfolios investing across multiple stocks and bonds, balancing risk and reward.

- Index Funds: Track a specific market index (like the S&P 500), offering broad market exposure at lower costs.

While precise historical performance data might not always be readily available, comparing these fund types allows you to assess the relative risk levels and make an informed choice. What investment strategy best aligns with your long-term financial goals?

Utilizing Plan Resources: Tools for Success

Many Ohio 457 plans offer helpful online tools to simplify planning:

- Retirement Planner: Estimate your retirement income based on savings, contributions, and projected investment returns. This helps visualize your future financial security.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of market fluctuations. DCA helps reduce the impact of market volatility on your overall investment strategy.

These resources are invaluable for making informed decisions and maximizing your retirement savings. Have you explored the retirement planning tools available through your Ohio 457 plan?

Navigating Withdrawals: A Step-by-Step Guide

Withdrawing from your 457 plan requires careful planning and adherence to specific rules. Early withdrawals often involve penalties, making it advisable to wait until retirement age (typically 59 1/2, but check your plan documents). Here’s a general process:

- Review Plan Documents: Familiarize yourself with allowable withdrawal methods and any associated fees.

- Choose Your Withdrawal Strategy: Decide on a lump sum or phased withdrawals. Each method has implications for your tax liability and overall financial planning.

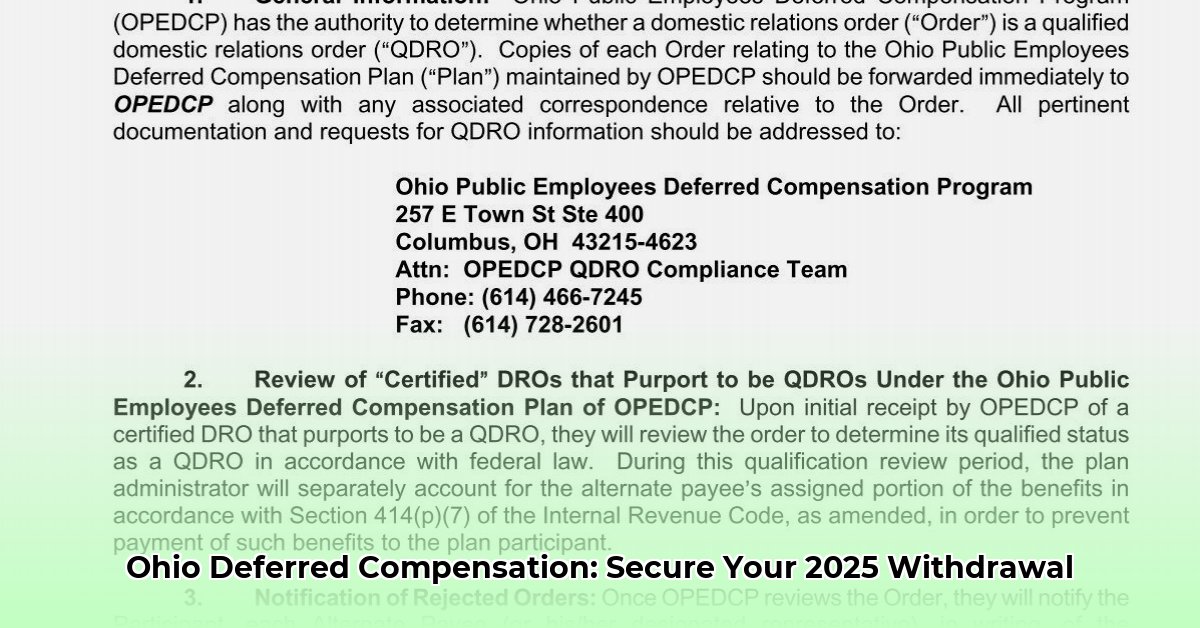

- Contact the Plan Administrator: They can guide you through the process and address any questions you may have.

- Complete Necessary Paperwork: Ensure all forms are accurately and completely filled out.

- Submit Your Application: Once completed, submit your application and await processing.

Roth 457 vs. Traditional 457: Making the Right Choice

The decision between a Roth 457 and a traditional 457 hinges on your current and projected tax brackets:

- Roth 457: Contributions are taxed now, but withdrawals in retirement are tax-free.

- Traditional 457: Contributions are tax-deductible now, but withdrawals are taxed in retirement.

Consider consulting a financial advisor to determine which aligns best with your individual circumstances. What tax implications do you need to consider when choosing between a Roth and traditional 457?

Additional Tips for a Secure Retirement

- Consult a Financial Advisor: Personalized guidance can significantly enhance your retirement planning.

- Stay Informed: Regularly review your plan documents and stay updated on any changes or new provisions.

Remember, this guide provides general information. Always refer to your official plan documents and consult a financial professional for personalized advice tailored to your specific situation. What are your key priorities for a comfortable retirement? Early planning leads to a more secure future.